Section 8 Company

A company with objectives of promoting science, commerce, education, art, sports, research, social welfare, religion, charity, etc.. Can get registration under section 8 of the companies to act as a non-profit organization.

It has various advantages when compared to Trust or Society like improved recognition and better legal standing. Section 8 company also has higher credibility amongst donors, Government departments and other stakeholders.

Trusted

We have 7+ Years of expertise.

Fair Prices

Best Price you will get in the market.

Hassle Free

All your tedious work is taken care of.

Package

Calculator

Documents

Required

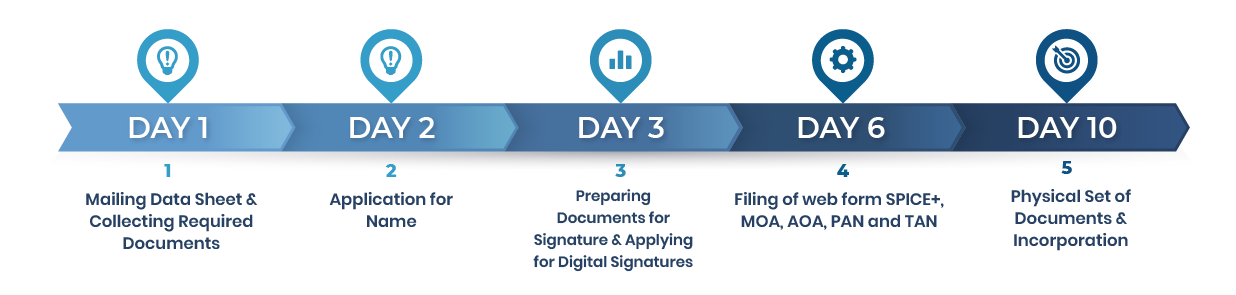

Timeline of

completion

Common

Questions

Timeline

Package & Pricing

Make your own customize package.

Basic Plan Includes

• Digital Signature Token for 2

• DIN for 2 Directors

• AOA, MOA

• MCA fees for Incorporation

• Company Name Approval

• Incorporation Certificate

• Company PAN Card

• Company TAN/TDS Number

• Company Round Stamp

• Hard Copy of Share Certificate

• Esic

• PF Number

• PT

• Directors Round Stamp for 2

• Bank Account Documents

• form inc 12

Thanks, we will contact you soon

Add-ons

Select extra add-ons if require

GST Registration

Udhyog Aadhar Registration

Start Up India Registration

0$

Select a Package

Basic Package Includes = • Digital Signature Token for 2 • DIN for 2 Directors • AOA, MOA • MCA fees for Incorporation • Company Name Approval • Incorporation Certificate • Company PAN Card • Company TAN/TDS Number • Company Round Stamp • Hard Copy of Share Certificate • Esic • PF Number • PT • Directors Round Stamp for 2 • Bank Account Documents

Basic Plan

0$

Other Services

Select extra add-ons if require

Trademark Search

Trademark Registration

Logo designing

Company Branding

Corporate presentation / Pitch Deck & Business projections

0$

Compliance

Monthly & Annual compliance both are available.

Monthly

Annually

0$

Final Cost

The final estimated price is :

Summary

| Description | Information | Quantity | Price |

|---|---|---|---|

| Discount : | |||

| Total : | |||

advantages

Tax

Exemption

Read More

No Minimum

Capital

Read More

No Stamp

Duty

Read More

Legal

Entity

Read More

No Title

Required

Read More

More

Credible

Read More

FAQ's

For simple questions, simple way of answer.

Do we need to take any permission from the Central government?

What is the purpose of the Section 8 Company Registration in India?

2. Poverty

3. Disease

4. Blood bank

5. Environment protection

6. Other objects for general public utility.

What are the annual compliance's to be followed by Section 8 Company?

• At least two Board meeting during the year should be conducted

• Mandatory Audit

• An annual return is to be filed every year with other e- filing forms like MGT 7, AOC 4.

• An income tax return is to be filed every year.

• Additional compliances to fulfill the registration like 12AA, 80G, etc.

How to appoint an auditor in Section 8 Company?

Are there any disadvantages under Section 8 Company registration?

2. Section 8 compliance cost is high as compared to any other trust or society

3. Penalty provisions are harsh under section 8 company.