Limited Liability Partnership

Limited liability partnerships(LLP) allow for a partnership structure where each partner’s liabilities are limited to the amount they put into the business.

Having business partners means spreading the risk, leveraging individual skills and expertise, and establishing a division of labor.

Trusted

We have 7+ Years of expertise.

Fair Prices

Best Price you will get in the market.

Hassle Free

All your tedious work is taken care of.

Package

Calculator

Documents

Required

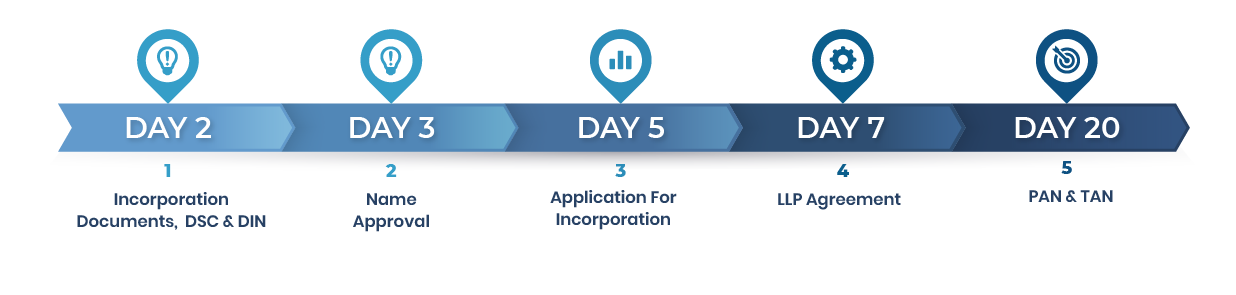

Timeline of

completion

Common

Questions

Contact Us

Give your requirement & we’ll get back to you in a heartbeat!

Timeline

Package & Pricing

Make your own customize package.

Basic Plan Includes

• Digital Signature Token for 2 PARTNERS

• DIN for 2 PARTNERS

• MCA fees for Incorporation

• Name Approval of LLP

• Incorporation Certificate

• LLP agreement filing

• LLP agreement drafting

• Company PAN Card

• Company TAN/TDS Number

• Bank Account Documents

• Round Stamp for 2 Partners

Thanks, we will contact you soon

Add-ons

Select extra add-ons if require

GST Registration

PTEC Registration

PTRC Registration

Udhyog Aadhar Registration

Start Up India Registration

0$

Select a Package

Basic Package Includes = • Digital Signature Token for 2 • DIN for 2 Directors • MCA fees for Incorporation • Company Name Approval • Incorporation Certificate • Company PAN Card • Company TAN/TDS Number • Company Round Stamp • Hard Copy of Share Certificate • Directors Round Stamp for 2 • Bank Account Documents

Basic Plan

0$

Other Services

Select extra add-ons if require

Trademark Search

Trademark Registration

Logo designing

Company Branding

Corporate presentation / Pitch Deck & Business projections

0$

Compliance

Monthly & Annual compliance both are available.

Monthly

Annually

0$

Final Cost

The final estimated price is :

Summary

| Description | Information | Quantity | Price |

|---|---|---|---|

| Discount : | |||

| Total : | |||

advantages

Easy To

Register

Read More

No Minimum

Capital

Read More

Lesser

Compliances

Read More

Correspondingly, the partners can come to a decision and organize their internal management mutually which will be in the LLP agreement. Only two forms are required to be filed annually, i.e. Form 8 and Form 11.

No Compulsory

Audit

Read More

Easy To

Operate

Read More

In private limited company, you entail board resolutions to be passed for taking any verdict; though, no such obligation is there in LLP, though the decision is still taken by the majority or in consonance with the LLP agreement.

Legal

Entity

Read More

limitations

Restricted Access

to Capital Markets

Read More

Restriction on

Trade of Shares

Read More

Increased Legal

Compliance

Read More

High Admin

Costs

Read More

Limited Personal

Control

Read More

Unlike in sole proprietorships, founders of a private limited company don’t have total control over the entity’s operations. When founders decide to privately issue shares to others, they invite more owners into the business. With reduced control, founders typically cannot make and execute important decisions without consulting with other shareholders.

FAQ's

For simple questions, simple way of answer.