Proprietorship

Sole Proprietorship, also known as the sole trader, is a type of business entity that is owned and run by one natural person and in which there is no legal distinction between the owner and the business. It is one of the most popular kinds of business to begin in the unsystematic sector, specifically among merchants and small traders. The owner receives all profits (subject to taxation specific to the business) and has unlimited responsibility for all losses and debts.

Trusted

We have 7+ Years of expertise.

Fair Prices

Best Price you will get in the market.

Hassle Free

All your tedious work is taken care of.

Package

Calculator

Documents

Required

Timeline of

completion

Common

Questions

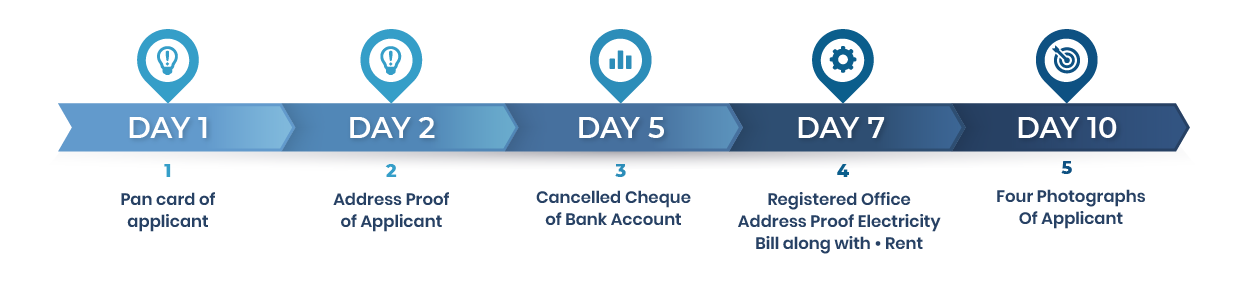

Timeline

Package & Pricing

Make your own customize package.

Basic Plan Includes

• Digital Signature Token for 2

• DIN for 2 Directors

• AOA, MOA

• MCA fees for Incorporation

• Company Name Approval

• Incorporation Certificate

• Company PAN Card

• Company TAN/TDS Number

• Company Round Stamp

• Hard Copy of Share Certificate

• Directors Round Stamp for 2

• Bank Account Documents

Thanks, we will contact you soon

Add-ons

Select extra add-ons if require

GST Registration

PTEC Registration

PTRC Registration

Udhyog Aadhar Registration

Start Up India Registration

0$

Select a Package

Basic Package Includes = • Digital Signature Token for 2 • DIN for 2 Directors • AOA, MOA • MCA fees for Incorporation • Company Name Approval • Incorporation Certificate • Company PAN Card • Company TAN/TDS Number • Company Round Stamp • Hard Copy of Share Certificate • Directors Round Stamp for 2 • Bank Account Documents

Basic Plan

0$

Other Services

Select extra add-ons if require

Trademark Search

Trademark Registration

Logo designing

Company Branding

Corporate presentation / Pitch Deck & Business projections

0$

Compliance

Monthly & Annual compliance both are available.

Monthly

Annually

0$

Final Cost

The final estimated price is :

Summary

| Description | Information | Quantity | Price |

|---|---|---|---|

| Discount : | |||

| Total : | |||

advantages

Direct

Control

Read More

Simple to

Register

Read More

Low

Cost

Read More

Income Tax

Benefits

Read More

limitations

Difficult to

Raise Capital

Read More

Unlimited

Liability

Read More

Limited

Life

Read More

FAQ's

For simple questions, simple way of answer.

Can an NRI start a business under sole proprietorship?

How is a sole proprietorship different from other company structures?

• Sole proprietors are the cheapest business type when it comes to operational and other costs.

• Sole proprietorships are the least complex of the legally recognized business structures.

• Sole proprietorships are exempt from mandatory state registration laws.

• Sole proprietorships don’t require formal paperwork.

• Sole proprietorships don’t shield individuals from business-related debts or liability.

• Sole proprietorships don’t require a tax filing separate from personal income. Naturally, there are many differences between sole proprietorships and corporations, but these are some of the most noticeable hallmarks of them.