Partnership Firm Registration

A Partnership is one of the most important forms of a business organization, where two or more people agree to cooperate to advance their mutual interests. They share liabilities as well as profits of the firm in a predetermined ratio. In India, Partnerships are widely prevalent because of their ease of formation and minimal regulatory compliance.

Trusted

We have 7+ Years of expertise.

Fair Prices

Best Price you will get in the market.

Hassle Free

All your tedious work is taken care of.

Package

Calculator

Documents

Required

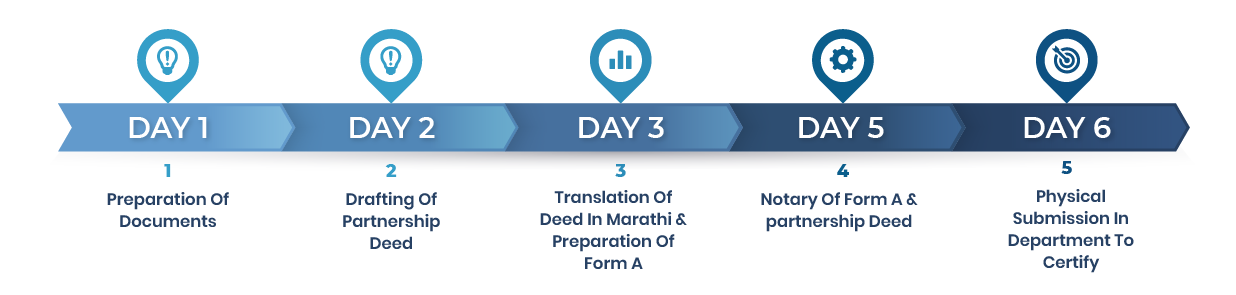

Timeline of

completion

Common

Questions

Timeline

Package & Pricing

Make your own customize package.

Basic Plan Includes

• Partnership deed drafting

• Partnership deed notarization

• Company PAN Card

• Company TAN/TDS Number

Thanks, we will contact you soon

Add-ons

Select extra add-ons if require

GST Registration

PTEC Registration

PTRC Registration

Udhyog Aadhar Registration

Start Up India Registration

0$

Select a Package

Basic Package Includes = • Partnership deed drafting • Partnership deed notarization • Company PAN Card • Company TAN/TDS Number

Basic Plan

0$

Other Services

Select extra add-ons if require

Trademark Search

Trademark Registration

Logo designing

Company Branding

Corporate presentation / Pitch Deck & Business projections

0$

Compliance

Monthly & Annual compliance both are available.

Monthly

Annually

0$

Final Cost

The final estimated price is :

Summary

| Description | Information | Quantity | Price |

|---|---|---|---|

| Discount : | |||

| Total : | |||

advantages

Easy Formation

& Dissolution

Read More

Winding up of a Partnership Firm can be done by simply entering into a dissolution deed. There are very less legal processes for winding up a Partnership Firm as compared to a Company.

No Annual

Compliances

Read More

Risk

Sharing

Read More

Better

Management

Read More

limitations

Unlimited

Liability

Read More

Each partner is ‘jointly and severally’ liable for the Partnership’s debts; that is, each partner is liable for their share of the Partnership debts as well as being liable for all the debts.

Trust

Issue

Read More

Raising

Capital

Read More

Abrupt

Dissolution

Read More

FAQ's

For simple questions, simple way of answer.