Private Limited Company

A Private Limited Company is a type of privately held small business entity, in which owner’s liability is limited to their shares, the company is limited to having 200 or fewer shareholders, and shares are prohibited from being publicly traded. A company becomes an independent legal structure when it incorporates. Private Limited Company Registration is more suitable for Startups looking for Funding and Long term Growth.

Trusted

We have 7+ Years of expertise.

Fair Prices

Best Price you will get in the market.

Hassle Free

All your tedious work is taken care of.

Package

Calculator

Documents

Required

Timeline of

completion

Common

Questions

Contact Now

Give your requirement & we’ll get back to you in a heartbeat!

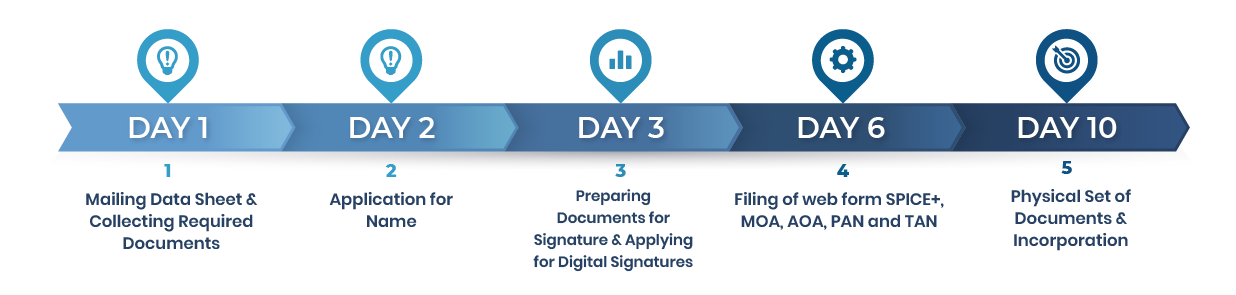

Timeline

Package & Pricing

Make your own customize package.

Basic Plan Includes

• DIN for 2 Directors

• AOA, MOA

• MCA fees for Incorporation

• Company Name Approval

• Incorporation Certificate

• Company PAN Card

• Company TAN/TDS Number

• Company Round Stamp

• Esic

• PF Number

• PT

• Hard Copy of Share Certificate

• Directors Round Stamp for 2

• Bank Account Documents

Thanks, we will contact you soon

Add-ons

Select extra add-ons if require

GST Registration

Udhyog Aadhar Registration

Start Up India Registration

0$

Select a Package

Basic Package Includes = • Digital Signature Token for 2 • DIN for 2 Directors • AOA, MOA • MCA fees for Incorporation • Company Name Approval • Incorporation Certificate • Company PAN Card • Company TAN/TDS Number • Company Round Stamp • Hard Copy of Share Certificate • Esic • PF Number • PT • Directors Round Stamp for 2 • Bank Account Documents

Basic Plan

0$

Other Services

Select extra add-ons if require

Trademark Search

Trademark Registration

Logo designing

Company Branding

Corporate presentation / Pitch Deck & Business projections

0$

Compliance

Monthly & Annual compliance both are available.

Monthly

Annually

0$

Final Cost

The final estimated price is :

Summary

| Description | Information | Quantity | Price |

|---|---|---|---|

| Discount : | |||

| Total : | |||

advantages

Limited

Liability

Read More

Limited liability means the status of being legally responsible only to a limited amount for debts of a company. This means the personal assets of the owners are protected if an employee, a business partner or the company itself is sued for negligence. This is especially important for owners with significant amounts of personal assets that they do not want to risk..

Brand

Value

Read More

Private limited company is popular and well known business structure. Corporate Customers, Vendors and Govt. Agencies prefer to deal with Private Limited Company instead of proprietorship or normal partnerships..

Easy to

Raise Funds

Read More

Owing to the corporate entity structure, it becomes feasible for startups and growing businesses to raise funding from angel investors, venture capitalists, etc..

Flexible

Management

Read More

Investors love to invest in Private Limited companies as it is well structured and less strings attached. Most important it is very easy to exit from a private limited company..

Easy to

Sell

Read More

Private Ltd. is easy to sell, very less documentation and cost is involved in selling a Pvt. Ltd. company..

Continuous

Existence

Read More

The existence of Private Limited Company is separate from the existence of its owners. It will continue to exist even if the present directors and members cease to exist in the future..

limitations

Restricted Access

to Capital Markets

Read More

Restriction on

Trade of Shares

Read More

Increased Legal

Compliance

Read More

Higher Admin

Costs

Read More

Limited Personal

Control

Read More

Unlike in sole proprietorships, founders of a private limited company don’t have total control over the entity’s operations. When founders decide to privately issue shares to others, they invite more owners into the business. With reduced control, founders typically cannot make and execute important decisions without consulting with other shareholders.

FAQ's

For simple questions, simple way of answer.