One Person Company

An OPC is a hybrid structure where the owner will enjoy all the benefits of a Private Limited Company which precisely means that the owner will have the access to bank loans, credits, limited liability, legal protection, etc. all in the name of an independent entity. An OPC Registration is governed by the Companies Act, 2013 and administered by MCA.

Trusted

We have 7+ Years of expertise.

Fair Prices

Best Price you will get in the market.

Hassle Free

All your tedious work is taken care of.

Package

Calculator

Documents

Required

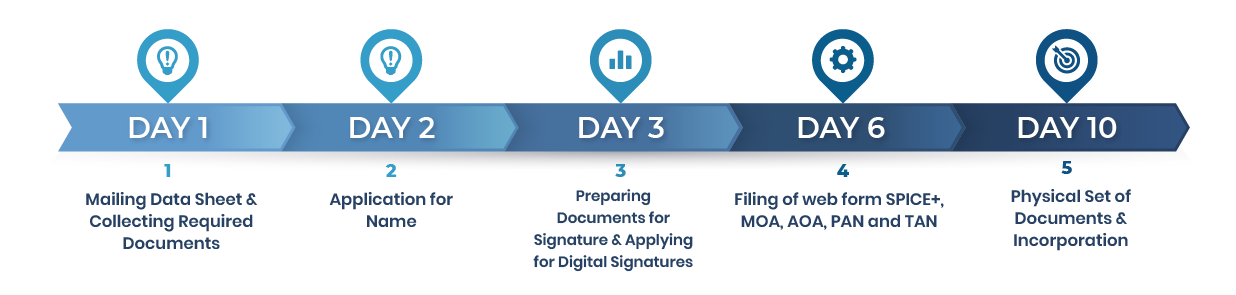

Timeline of

completion

Common

Questions

Timeline

Package & Pricing

Make your own customize package.

Basic Plan Includes

• Digital Signature Token for 1

• DIN for Promoter

• AOA, MOA

• MCA fees for Incorporation

• Company Name Approval

• Incorporation Certificate

• Company PAN Card

• Company TAN/TDS Number

• Company Round Stamp

• Hard Copy of Share Certificate

• Esic

• PF Number

• PT

• Directors Round Stamp

• Bank Account Documents

Thanks, we will contact you soon

Add-ons

Select extra add-ons if require

GST Registration

Udhyog Aadhar Registration

Start Up India Registration

0$

Select a Package

Basic Package Includes = • Digital Signature Token for 1 • DIN for Promoter • AOA, MOA • MCA fees for Incorporation • Company Name Approval • Incorporation Certificate • Company PAN Card • Company TAN/TDS Number • Company Round Stamp • Hard Copy of Share Certificate • Esic • PF Number • PT • Directors Round Stamp • Bank Account Documents

Basic Plan

0$

Other Services

Select extra add-ons if require

Trademark Search

Trademark Registration

Logo designing

Company Branding

Corporate presentation / Pitch Deck & Business projections

0$

Compliance

Monthly & Annual compliance both are available.

Monthly

Annually

0$

Final Cost

The final estimated price is :

Summary

| Description | Information | Quantity | Price |

|---|---|---|---|

| Discount : | |||

| Total : | |||

advantages

Less Secretarial

Compliance

Read More

It is not mandatory for OPCs to prepare a cash flow statement.

Creditable

Party

Read More

Sole

Ownership

Read More

Seprate

Legal Entity

Read More

A company enjoys the status of an artificial person who is eligible to acquire, own enjoy and alienate property in its name. The property that is owned by the company could be buildings, land, machinery, intangible assets, factory, residential property, etc. Additionally, the nominee director is prohibited to claim any ownership of the company while serving as the nominee director.

Easy

Formation

Read More

limitations

Restricts Foreign

Investment

Read More

Restriction on

Conversion

Read More

An OPC can only convert into either a private or public company once the following conditions are met:

1. The OPC must have been in existence for a minimum of two years; or

2. It must have a paid-up share capital which has increased beyond Rs. 50,00,000/- (rupees fifty lakh); or

3. Its average turnover must have exceeded Rs. 2,00,00,000/- (rupees two crore).

Ownership

Limitations

Read More

No

Esops

Read More

FAQ's

For simple questions, simple way of answer.

How many Directors can OPC appoint?

Least requirements for OPC registration?

• At least 1 director. The director and shareholder can be the same person.

• Minimum one nominee

• Shareholder/nominee need to be a resident of India

• Minimum Rs.1 lakh to be authorized share capitals.

• DSC and DIN for director

Can OPC be incorporated or converted to a Section 8 Company?

As per Rule 3(5) of the Companies (Incorporation) Rules 2014, the answer is ‘No’.