Public Limited Company

The Public Limited Company is a large business entity that has limited liability and also offers shares to the public. It provides huge benefits to the people compared to the Private Limited Company. Public Limited Company enjoys benefits like ease of transferability, limited liability, borrowing capacity, and perpetual existence.

Trusted

We have 7+ Years of expertise.

Fair Prices

Best Price you will get in the market.

Hassle Free

All your tedious work is taken care of.

Package

Calculator

Documents

Required

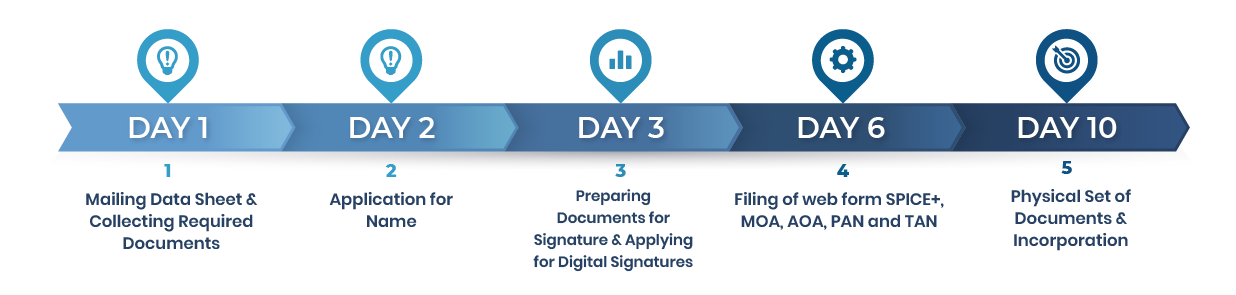

Timeline of

completion

Common

Questions

Timeline

Package & Pricing

Make your own customize package.

Basic Plan Includes

• Digital Signature Token for 7

• Digital Signature Token for 7

• DIN for 3 Directors

• AOA, MOA

• MCA fees for Incorporation

• Company Name Approval

• Incorporation Certificate

• Company PAN Card

• Company TAN/TDS Number

• Company Round Stamp

• Hard Copy of Share Certificate

• Esic

• PF Number

• PT

• Directors Round Stamp for 3

• Bank Account Documents

• Commencement of business certificate

Thanks, we will contact you soon

Add-ons

Select extra add-ons if require

GST Registration

Udhyog Aadhar Registration

Start Up India Registration

0$

Select a Package

Basic Package Includes = • Digital Signature Token for 7 • DIN for 3 Directors • AOA, MOA • MCA fees for Incorporation • Company Name Approval • Incorporation Certificate • Company PAN Card • Company TAN/TDS Number • Company Round Stamp • Hard Copy of Share Certificate • Esic • PF Number • PT • Directors Round Stamp for 3 • Bank Account Documents • Commencement of business certificate

Basic Plan

0$

Other Services

Select extra add-ons if require

Trademark Search

Trademark Registration

Logo designing

Company Branding

Corporate presentation / Pitch Deck & Business projections

0$

Compliance

Monthly & Annual compliance both are available.

Monthly

Annually

0$

Final Cost

The final estimated price is :

Summary

| Description | Information | Quantity | Price |

|---|---|---|---|

| Discount : | |||

| Total : | |||

advantages

Quick Share Transfer

Read More

Shareholders of a public limited company can transfer their shares with great ease. All they need to do is file the share transfer form and hand over the share certificate to the buyer. The process of transferring your share in other business structures is hugely tedious..

Raise Capital

Read More

The big advantage of the public limited structure is that you can leverage it to raise capital from the general public through shares. This would, however, require listing on a stock exchange. All public limited companies can issue fixed deposits, debentures, convertible debentures to the general public..

Greater Credibility

Read More

Public limited companies need to disclose their audited statement of accounts, inform the regulatory bodies of any structural change and hold annual general body meetings for all shareholders. It’s tedious but these compliances bring a public limited company a great deal of credibility to the organisation..

Growth Opportunities

Read More

Due to less risk, there is a perfect opportunity for growing and expanding the business by investing in new projects from the money raised through shares..

More Attention

Read More

Being listed on a stock market ensures that mutual funds, hedge funds, and other traders take note of the business of the company. This may result in better business opportunities for the Public Limited Company..

Spreading Risk

Read More

Since the shares are sold to the public at large the unsystematic risk of the market is spread out..

limitations

Increased Legal

Compliance & Cost

Read More

Public Disclosure of

Company Info

Read More

A company must file its Annual Returns, Financial Statements, Auditor’s reports, Board’s Report etc to the Registrar of Companies. Which become public document once filed with Registrar of Companies and may be inspected by general public including competitors by paying some fees to the Registrar of Companies. Information disclosure can make an entity competitively disadvantaged. Competitors – especially those not required to disclose any documents – can access that information and use it to improve their own business. Further Public disclosure of the financial affairs is necessary and greater public scrutiny of the company’s financial performance and actions.

Limited Personal

Control

Read More

When promoters decide to privately issue shares to outsiders, they invite large number of new owners into the business. With reduced control, promoters typically cannot make and execute important decisions without consulting with other shareholders. Decisions take longer and there may be disagreement. And therefore personal touch may be lost.

Shared

Profits

Read More

Profits are shared amongst a far greater number of people.

FAQ's

For simple questions, simple way of answer.

What is the minimum and maximum limit of directors to form a public limited company?

In case of Public Limited Company, Minimum three (3) and Maximum Fifteen (15) numbers of directors are required.

Who can be Shareholder/Member in Public Limited Company?

Any individual/Company/LLP can become a member of the private limited company including foreigners/NRI. However, the individual must 18+ above in terms of age and should have a valid PAN card.

What are the minimum requirements of Company Registration?

- Minimum 3 Director

- Minimum 7 Shareholder

- DIN (Director Identification Number for all Director)

- DSC (Digital Signature Certificate for all the Directors)

- Minimum Share Capital of Rs. 5,00,000/-

- The Director and Shareholder can be same

Are there any hidden charges after I take any of your Service?

No Hidden charges. Every details regarding charges are mentioned in the Quotation file sent to you.

What is Paid-Up Capital?

Paid up share capital of a company is the amount of money for which share were issued to the shareholder and for which payment was made by shareholder. Paid up capital will always be less than the authorized capital as the company cannot issues shares above its authorize capital.

Where do I get CIN No of the Company?

CIN is always mentioned at Certificate of Incorporation of the Company, you are required to mention Company CIN at all commercial documents like Letter Heads, Visiting Cards, and Website of the Company.